You can lodge as early as July 1, but you will have 17 weeks to do it. If you go via a Registered Tax Agent, like CPL, you can extend til 31 October. Failing to submit will incur a fee from the ATO, of $330. It will also be another $330 for every 28 days late. Typically, you will receive your return within two (2) weeks. Important information, such as your Bank account details, including the BSB and Account number as well as your ID with you, will fastrack your appointment. The proposed changes will reduce benefits for higher-income earners, in order to fund returns for lower income earners.

Tax Cuts are from 1 July 2024. More in your pocket!

However, we can get you more. Book with us.

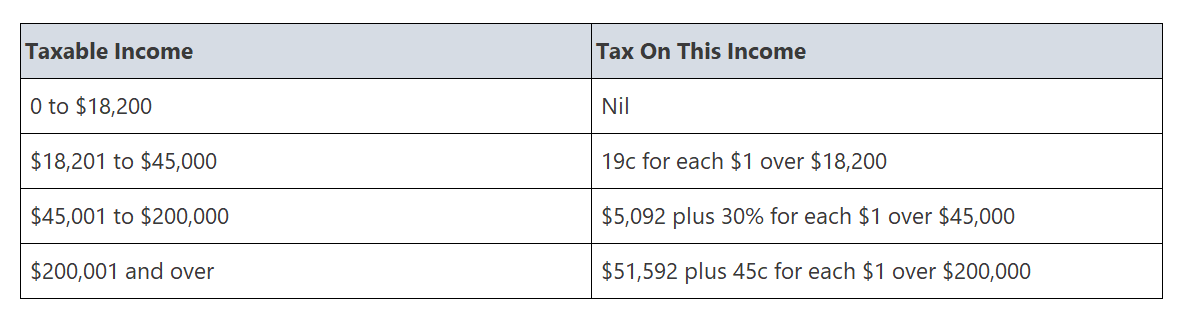

The table (below) lists an approximate tax cut for various income levels, compared to the

year prior.